child tax credit september date

It also allows 17-year-old children to qualify for the first time. Many parents with direct deposit set up had already received the money in their accounts Wednesday morning.

Schedule Date Of Gst Return Filling For Regular Business Accounting And Finance Accounting Course Filing Taxes

The third round will be paid out by direct deposit or paper check beginning on Wednesday Sept.

. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. 15 or be mailed as a paper check soon after. Those with kids between ages six and 17 will get 250 for every child.

How much will parents receive in September. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Payments will start going out on September 15 More than 30million households are set to receive the payments worth up to 300 per child starting September 15.

This months payment will be sent on September 15. The IRS will deposit the next advanced child tax credit payment on September 15 which the funds should appear in your bank account in a few days at max. When will I receive the September CTC payment.

You need to be registered by August 30 though to receive next payment in a months time. The third child tax credit payment is coming in just two weeks and will arrive in your bank account on Sept. 15 opt out by Aug.

What time the check arrives depends on the payment method and individual banks. The agency which distributed 15 billion in. 15 opt out by Nov.

The new programme will provide monthly payments of up to 300 for children under six and 250 for those aged between six and 17. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. 13 opt out by Aug.

Monthly payments will continue through December to amount to half 1800 of the full 3600 per qualifiable child. Families can receive 50 of their child tax credit via monthly payments between July 15 and Dec. Eligible families can get up to 300 for each child up to age 6 and up to 250 for each one ages 6 to 17.

The payment will mark the third monthly installment in a series of six checks being delivered by the federal government as a one-time extension of the normal Child Tax Credit. The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. 15 opt out by Nov.

The other 1800 will be eligible to be claimed next. Max refund is guaranteed and 100 accurate. Families with kids under the age of six will receive 300 per child.

This year most qualifying families are. The prior to the changes made in March. Septembers advanced child tax credit payment is on the 15th.

29 What happens with the child tax credit payments after December. Free means free and IRS e-file is included. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child brother sister stepbrother stepsister half-brother half-sister or a descendant of one of these for example a grandchild niece or nephew.

The White House expanded the child tax credit to help families struggling as the economy rebuilds. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. Eligible parents will receive 300 per child aged six or younger and 250 per child aged 6 to 17.

Child Tax Credit payments will be split over two tax years. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20 2022 June 20 2022 July 20 2022 August 19 2022 September 20 2022 October 20 2022 November 18 2022 December 13 2022 Havent received your payment.

To be a qualifying child for the 2021 tax year your dependent generally must. Under the latest legislation the child tax credit temporarily increases to 3000 per child or 3600 a child under 6. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. CBS Detroit The Internal Revenue Service IRS sent out the third round advance Child Tax Credit payments on September 15. 15 opt out by Oct.

The payments are due to come in on the 15th of each month unless it clashes with a public holiday. Families can claim up to 3600 per child under six years old and for children 6-17 years old they can claim 3000. All the payments have been scheduled for the 15th of the month including the upcoming September payment.

The second check was issued earlier this week so parents will have already received this months payment and the next check comes September 15. Advance payments will continue next month and through the end of the year thanks to the American Rescue Plan passed back in March.

Tax Credits Payment Dates 2022 Easter Christmas New Year

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit Will There Be Another Check In April 2022 Marca

The Battle Of Karansebes Romanian Caransebes Turkish Sebes Muharebesi Is A Possibly Apocryphal Episode In The Austro Turkis Battle History Articles Troops

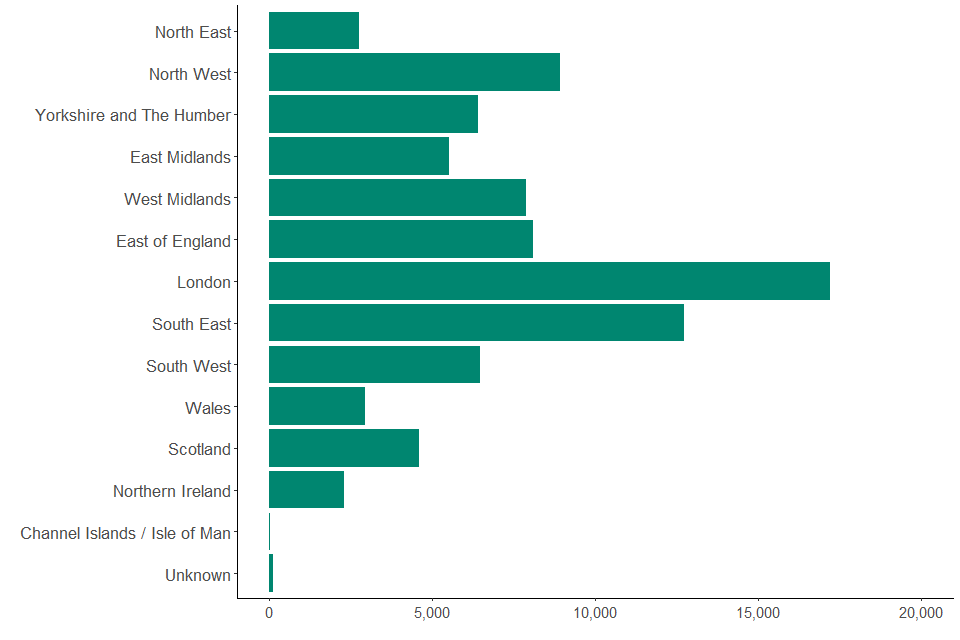

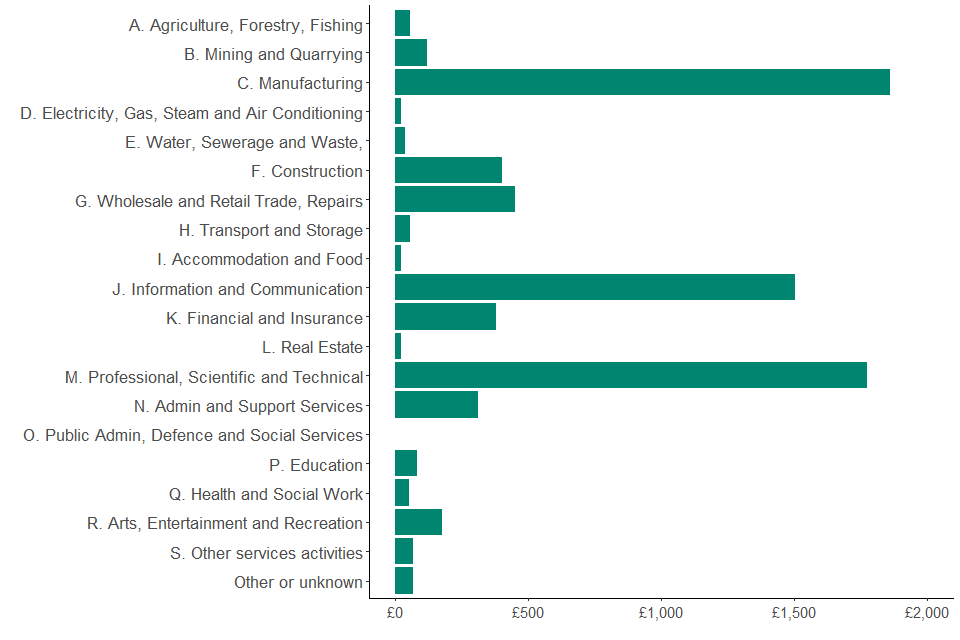

Research And Development Tax Credits Statistics September 2021 Gov Uk

2 Child Limit Policy Low Incomes Tax Reform Group

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Adance Tax Payment Tax Payment Dating Chart

Dates Cost Of Living Payments Will Be Paid To Uk Households Nationalworld

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Research And Development Tax Credits Statistics September 2021 Gov Uk

Itr Filing Deadline Nears How To File Income Tax Return Online Income Tax Return Tax Return Income Tax

Research And Development Tax Credits Statistics September 2021 Gov Uk